Manufacturing on Demand

Certified and Quality Driven

Full-Cycle Supply Chain Solutions

- Vetted Supplier Network

- Tight-tolerance Capabilities

- In-House Production Expertise

- Dedicated Program Management

- Multi-Year Program/Product Agreements

Trusted by Engineers and Purchasing Leaders at the World’s Most Successful Companies

“Xometry delivers professionalism and ease. They take care of fulfillment so I don’t need to juggle or manage suppliers. We buy the quote and Xometry takes care of the rest.”

Tooling Design Engineer, BMW

幸运飞行艇在线开奖直播-开奖历史记录-免费幸运飞行艇在线计划 Turbocharge the Way You Make Custom Parts

Put Our Digital Manufacturing Marketplace to Work for You

Instantly access the production capacity of over 10,000 manufacturers with wide-ranging capabilities and certifications across 46 US states, Europe, and Asia straight from your desktop. More on our Supplier Network.

Get pricing, lead times, and design-for-manufacturing feedback in a matter of clicks, not days. The Xometry Instant Quoting Engine® puts data science to work so you can easily choose your project’s optimal price and lead time. Learn more about our instant quoting technology.

We are ISO 9001:2015, ISO 13485:2016, and AS9100D certified. Xometry is ITAR registered. Learn more about our quality assurance.

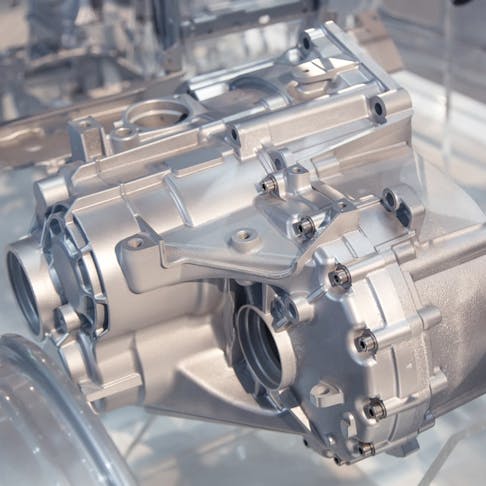

Our precision applications are perfect for aerospace, defense, automotive, medical, robotics, industrial, consumer electronics industries, and many more. We offer CoCs, material certifications, finishing certifications, inspection reports, and hardware certifications.

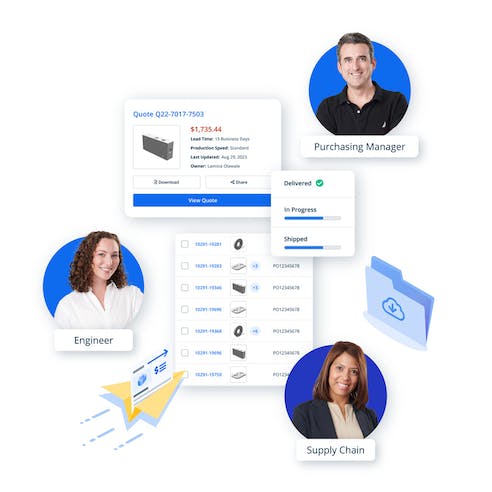

Maximize Collaboration with Teamspace

Collaborating with others on your manufacturing projects has never been easier with Teamspace. It is a feature within your Xometry account that allows you to easily work with other users on projects and custom part orders. Teams simplify purchasing workflows. For instance, you can get an instant quote on your personal dashboard, and when you’re ready to order, share the quote with an entire purchasing or procurement team you’ve made. Teamspace provides a unified Xometry experience, giving your team members quick and easy access to quotes, order placement, part statuses, tracking information, and more. You can create a Team today or click here to learn more about how Teamspace works.

We’re Your Partner From Prototyping to Production and Beyond

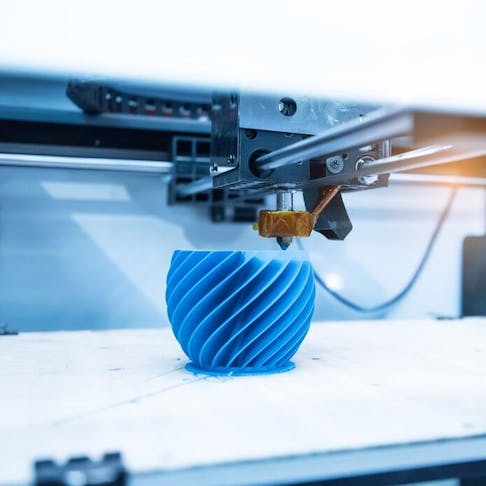

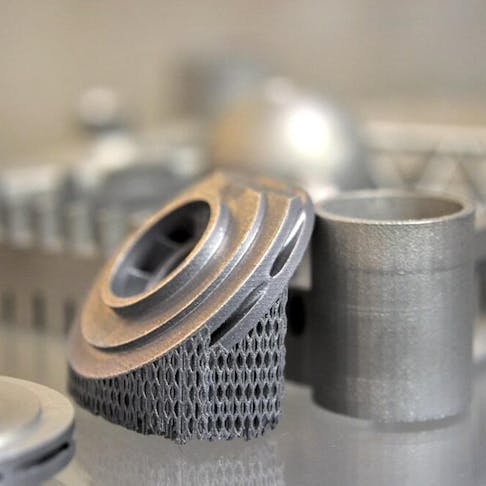

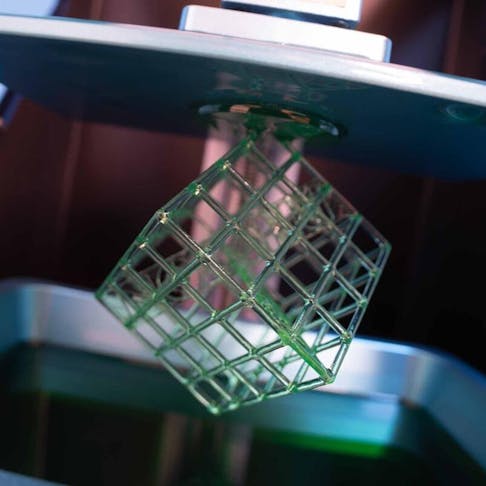

Xometry offers a range of solutions to help you develop effective prototypes and scale up to production parts. Make custom parts on demand using over 70 materials and 15 processes. Put our network of over 10,000 highly vetted manufacturers and our skilled applications engineering team to work for you.

Get quotes within seconds on CNC machining, 3D printing, sheet metal fabrication, urethane casting, and more. Upload a 3D CAD file and receive the price, lead time, and design-for-manufacturing feedback instantly.

Xometry delivers high-quality, on-demand injection molding for prototypes and production parts. Dozens of materials, insert molding, compression molding, silicone rubber molding, and more options are available.

Xometry adds value through its massive global supply chain and secondary services like assembly or weldments. The team can create, kit, and provide turnkey products to your specifications.

New to Xometry? Get started with a quote.

Metal and Plastic Production Solutions

Xometry’s digital manufacturing marketplace is your one-stop solution for production. Our team is the perfect solution for your product manufacturing needs with our staff of technical experts, ease of our secure quoting platform, and global manufacturing capacity.

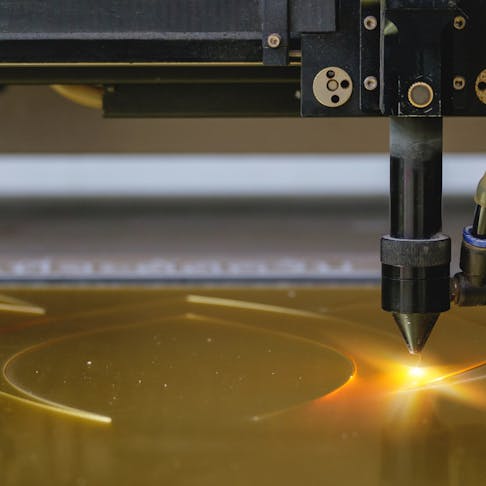

Xometry offers competitive pricing and lead times on plastic injection molding, metal injection molding, die casting, metal stamping, metal extrusion, plastic extrusion, sheet metal, laser cutting, waterjet cutting, laser tube cutting, and tube bending services. Start your quote or contact us today to begin.

Xometry Go Green Initiative

Xometry is committed to promoting environmental sustainability across our services. We have partnered with Dot Neutral, an organization that matches businesses with carbon emission offset initiatives, including reforestation, renewable energy, capturing harmful gases, and more.

Each time a package is shipped from all Xometry divisions, Dot Neutral charges Xometry a fee. That money is invested in an initiative to reduce or offset the emissions by up to 100%. Customers also have a choice to partially or wholly offset the emissions produced by fabricating their parts each time they order.

Learn more about our Go Green Initiative.

What Our Customers Say

Ready to Get a Quote?

Take advantage of our network and see what Xometry can do for you.

168幸运飞行艇历史开奖网址-开奖结果查询-幸运飞行艇走势分析 Latest Capabilities

Learn About Manufacturing Processes, Technologies, and Materials

Latest 3D Printing Guides

Latest Injection Molding Articles

Metal Injection Molding vs. Die Casting: Differences and Comparison

Latest Materials Articles

Compressibility: Definition, How It Works, Calculation, and Applications

168飞行艇官网开奖记录查询-数据记录-幸运飞行艇官网开奖结果 Latest Sheet Cutting Articles

By entering your contact information, you are agreeing to receive email communications about Xometry products and services. You may update your subscriptions or unsubscribe from these communications at any time using the link at the bottom of every marketing email or by contacting support. For more information, review our Privacy Policy.